No products in the cart.

How can you pay a 401k?

A 401(k) is the trusty income tax-advantaged, employer-backed plan accessible to assist employees rescue to have old age. An excellent 401(k) financing it permits individuals borrow money off their later years membership.

What is actually a great 401k Mortgage?

An excellent 401k financing allows a worker so you’re able to borrow funds off their advancing years family savings on intention of paying the money back. Whilst the private is borrowing funds from themself, the mortgage was treated particularly a non-consumer loan which have specific cost words and notice costs.

401k Regulations Legislation

Some large employers arranged their 401k intentions to enable it to be group when planning on taking a loan, particular smaller businesses dont. You will need to seek the advice of this package mentor or refer towards Realization Bundle Malfunction to decide if a beneficial 401k loan is additionally an alternative.

Furthermore, specific agreements were certain standards for whenever workers are allowed to deal with an excellent 401k mortgage, while others be open and allow borrowing for pretty much people need. Depending on the particular terms of the arrangements, it may be it is possible to to look at multiple 401k financing. Likewise, specific arrangements require the fellow member to find consent using their partner just before taking a loan more than $5,100. Most other plans do not have that it demands.

The borrowed funds should be paid in this five years by way of payroll deduction unless of course the bucks can be used to invest in a first household where the fresh borrower will alive full time. The staff need to generate repayments at the very least every quarter. If your financing is not paid punctually, it is recognized as taxable money therefore the number is actually strike having an excellent 10% early withdrawal percentage.

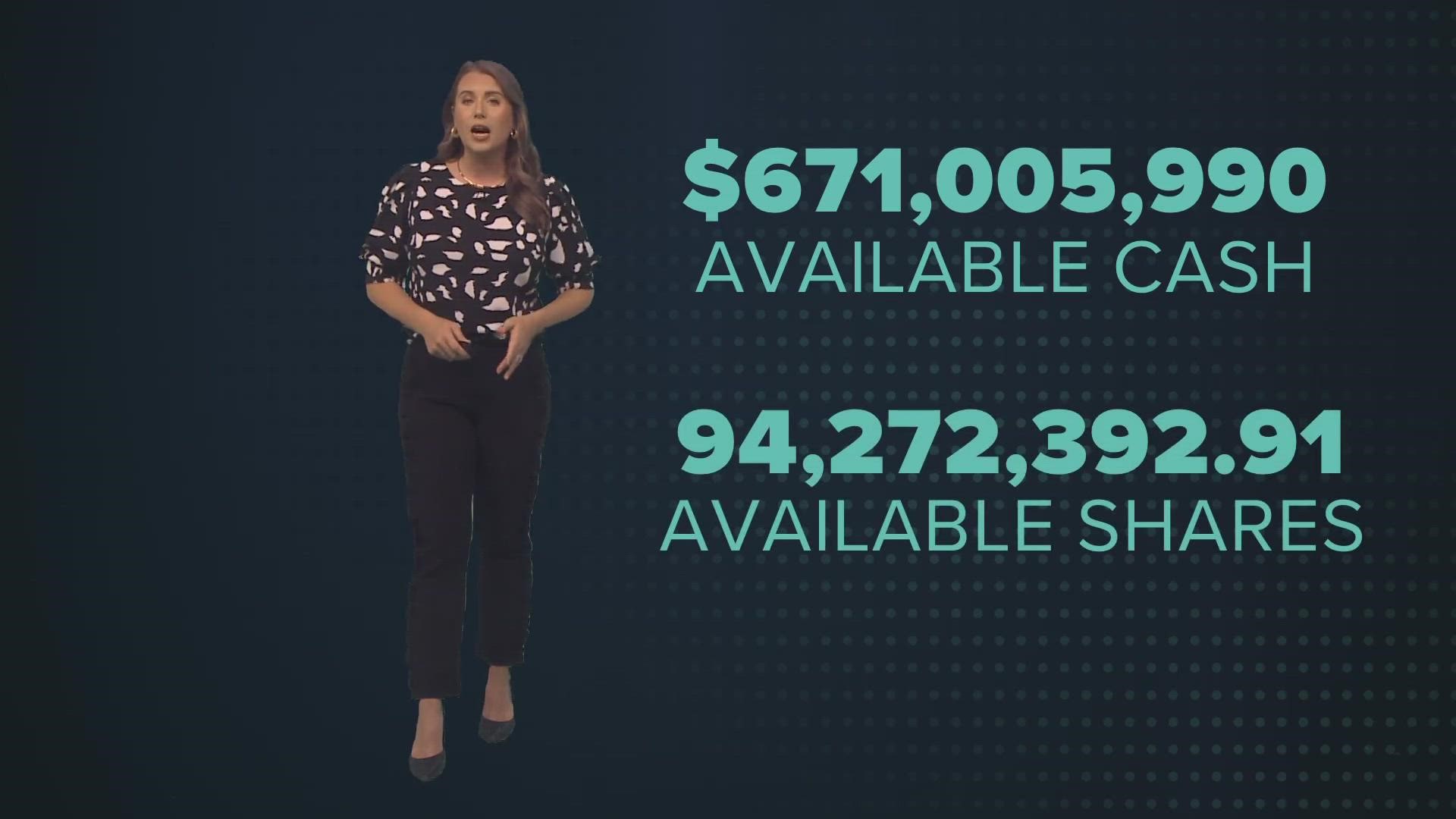

Maximum Obtain Matter Regarding good 401k

To own 401k preparations that let the fresh new personnel to take out a good loan, it certainly is you can easily to borrow around fifty% of your own count vested throughout the want to a total of $50,000, any sort of was reduced. Specific agreements give a different towards the 50% restrict of these that have a balance lower than $ten,000. In such a case, the latest personnel can be borrow as much as $10,000. The maximum amount is determined because of the Internal revenue service. Yet not, other plans enjoys other borrowing limits.

401k Mortgage Interest

Eg a frequent loan, good 401k mortgage boasts desire costs. not, quick cash loan the attention costs come back towards employee’s 401k membership. The degree of attention paid off can differ between arrangements it is always according to research by the newest prime rates. It is very important note that most of the interest payments is actually reduced having after-income tax cash. If staff member renders a detachment for the advancing years, they are taxed once more.

Important: While you are 401k funds return to the employee’s 401k membership, desire costs are produced with just after-tax dollars. In the event that staff tends to make a detachment from inside the senior years, they will be taxed once more. It means the eye costs could be taxed twice.

When to Acquire From good 401k

Before credit money from a good 401k, an employee is always to look other mortgage supplies. Credit from good 401k may have a poor affect much time-title income, possibly decreasing the amount of cash a worker will receive offered if they are prepared to retire.

Regardless of if credit regarding an excellent 401k isn’t necessarily a knowledgeable monetary circulate, you will find some activities in which a member of staff can get determine it ‘s the correct choice. In the event the staff need the money having an emergency and that is confident they’re able to pay it back straight back in this five years, it may be the proper action to take.

Teams can usually sign up for an excellent 401k financing to find good primary home. Whenever you are you’ll find drawbacks so you can taking on a 401k mortgage (borrowing from the bank restrictions, attract money) it could be a much better choice than withdrawing money from a great 401k. One withdrawal regarding good 401k before the age of 59 and you may ? years of age is actually classified just like the a good hardship detachment and that is at the mercy of an excellent ten% very early withdrawal penalty and it is subject to tax.

WhatsApp Us 24/7

WhatsApp Us 24/7